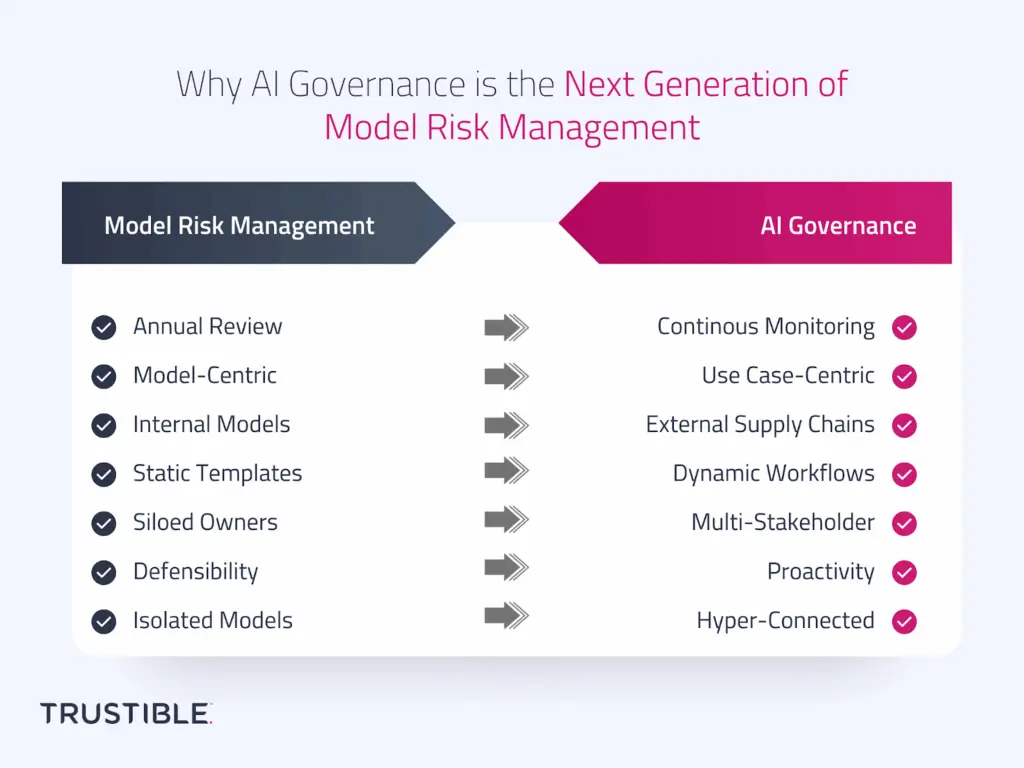

For decades, Model Risk Management (MRM) has been a cornerstone of financial services risk practices. In banking and insurance, model risk frameworks were designed to control the risks of internally built, rule-based, or statistical models such as credit risk models, actuarial pricing models, or stress testing frameworks. These practices have served regulators and institutions well, providing structured processes for validation, monitoring, and documentation.