As enterprises race to deploy AI across critical operations, especially in highly-regulated sectors like finance, healthcare, telecom, and manufacturing, they face a double-edged sword. AI promises unprecedented efficiency and insights, but it also introduces complex risks and uncertainties. Nearly 59% of large enterprises are already working with AI and planning to increase investment, yet only about 42% have actually deployed AI at scale. At the same time, incidents of AI failures and misuse are mounting; the Stanford AI Index noted a 26-fold increase in AI incidents since 2012, with over 140 AI-related lawsuits already pending in U.S. courts. These statistics underscore a growing reality: while AI’s presence in the enterprise is accelerating, so too are the risks and scrutiny around its use.

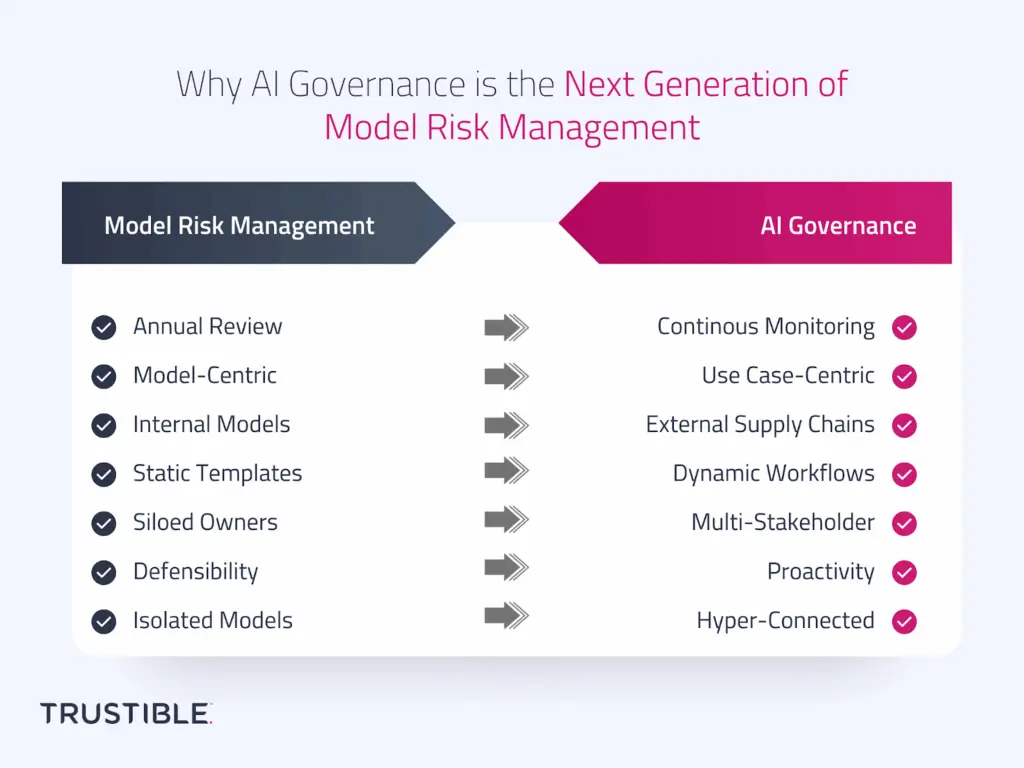

Why AI Governance is the Next Generation of Model Risk Management

For decades, Model Risk Management (MRM) has been a cornerstone of financial services risk practices. In banking and insurance, model risk frameworks were designed to control the risks of internally built, rule-based, or statistical models such as credit risk models, actuarial pricing models, or stress testing frameworks. These practices have served regulators and institutions well, providing structured processes for validation, monitoring, and documentation.

Introducing Trustible’s New US Insurance AI Framework: Simplifying AI Compliance for Insurers

At Trustible, we understand the challenges insurers face in navigating the evolving AI regulatory landscape, particularly at the state-level in the U.S. That’s why we’re excited to introduce the Trustible US Insurance AI Framework, designed to streamline compliance by synthesizing the latest insurance AI regulations into one comprehensive, easy-to-comply with framework embedded in our platform.

Operationalizing AI Governance in Insurance

Federal regulators have largely focused on issuing guidance and initiating inquiries into AI, whereas state regulators have taken a more proactive stance, addressing AI’s unique challenges within sectors such as insurance. The New York Department of Financial Services released a draft guidance letter proposing standards for identifying, measuring, and mitigation potential bias from use of […]

Everything you need to know about the Colorado AI Life Insurance Regulation (Regulation 10-1-1)

What is Colorado Regulation-10-1-1 ? In July 2021, Governor Jared Polis signed SB 21-169 into law, which directed the Colorado Division of Insurance (CO DOI) to adopt risk management requirements that prevent algorithmic discrimination in the insurance industry. After two years and several revisions, a final risk management regulation for life insurance providers was officially […]